A few weeks ago, we noted Mother Nature made a large dent in projected 2019 production and ending stocks. A few readers asked about the global ending stocks situation. For this week’s post, we review the global ending stock situation for corn, wheat, and soybeans and, as you might have guessed, considered China’s role in global crop inventories.

Global Stocks

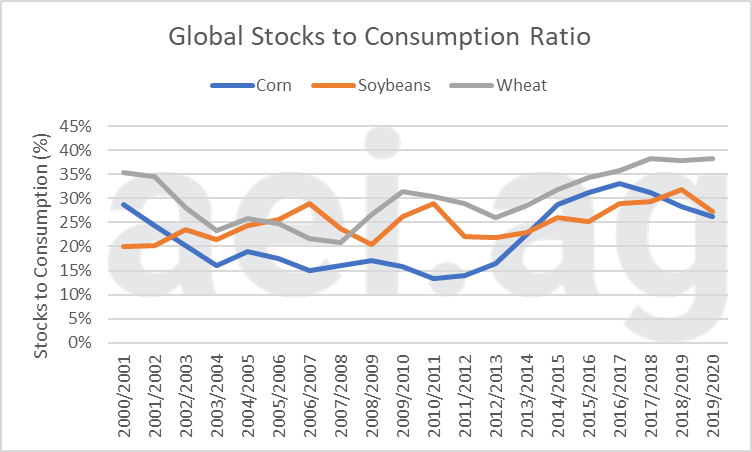

Figure 1 shows global ending stocks of corn, soybeans, and wheat relative to consumption since the 2000/2001 marketing year. The ending stock ratios are helpful as evaluating ending stocks in absolute terms (in total bushels or metric tons) gets messy as production and consumption have trended higher over time.

Overall, corn ending stocks (in blue) are generally the tightest among the three crops. Over the last 20 years, the corn ending stock to consumption ratio has averaged 22%. Note that for several years global corn stocks were near, or below, 15%. In recent years, corn inventories reached a high of 33% (2016/2017) before trending lower to an expected level of 26% for the current year.

Soybean ending stocks (in orange) have averaged 25% of consumption over the last two decades. Like corn, soybean stocks recently peaked (35% in 2017/2018), but have trended lower recently. Projected ending stocks for the current marketing year are 27%.

At an average of 30% of consumption, wheat stocks (in gray) are generally highest. Conditions in recent years have not improved, at least by this measure. For the current year, wheat inventories are at 38%, unchanged from 2017/2018, and 2018/2019 levels. Furthermore, current levels are at the highest in the 20 years, and one would have to search back to the 1980s to find as high as they are today.

Figure 1. Global Stocks to Consumption Ratio for Corn, Soybeans, and Wheat, 2000/2001 to 2017/2018. Data Source: UDSA’s FAS (Nov. 2019).

The China Factor

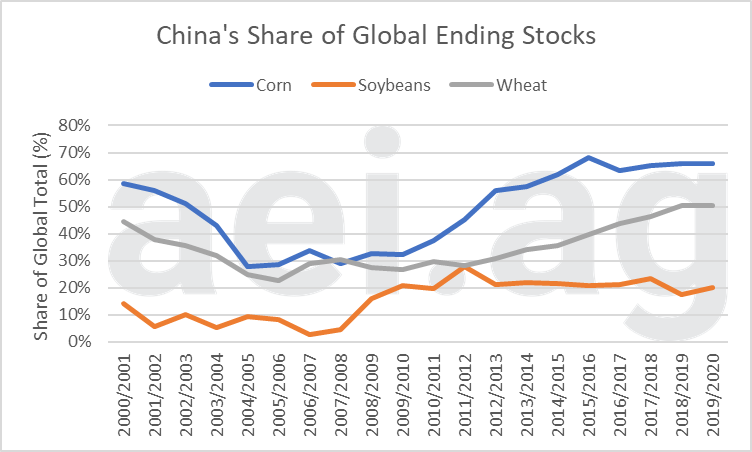

Any conversation about global crop inventories should consider China. Figure 2 shows China’s share of total global ending stock. For all three crops, China has accounted for a growing share of global inventories over the last 15 years. In some cases, the numbers are hard to phantom. In recent years, China has accounted for around two-thirds of all world ending stocks of corn. This is up from about 30% of stocks in the mid-2000s. China also accounts for more than half of all wheat stocks (up from 30% in the mid-2000s) and 20% of global soybeans (up from 10% in the early-2000s).

Given the trends and magnitudes, especially for corn and wheat, one should also consider world crop inventory levels less China. This is especially the case as China does not participate in the global export market of these crops. In other words, grain stock in China, at least historically, behave differently than stocks in other counties.

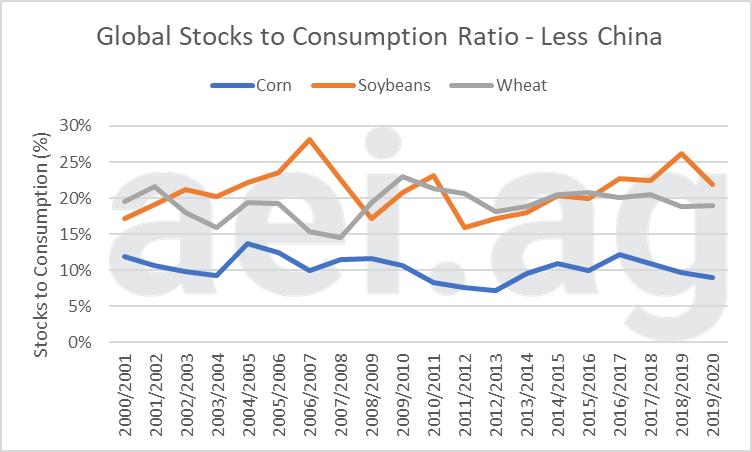

Figure 3 shows global stocks to consumption ratio less China’s inventories. A quick comparison between figures 1 and 3 show a much tighter stocks situation. Furthermore, the sharp uptick in stocks since the mid-2000s isn’t observable in Figure 3. Since 2000, corn ending stocks less China averaged 10% of annual consumption. For the current marketing year, corn stocks are expected to fall below the average (9%). For 2019/2020, soybean stocks (22%) are slightly above the 20-year average of 21%, and wheat stocks are on par with the average (19%). Rather than above-average levels, conditions less China are at, or near, the 20-year average.

Conditions are perhaps most stark with wheat. While the data in figure 1 show wheat approaching burdensomely high levels, conditions less China (figure 2) show levels have trended lower since peaking at 23% in the mid-2000s.

Figure 2. China’s Share of Global Stock, Corn, Wheat, and Soybeans. 2000/2001 to 2019/2020. Data Source: UDSA’s FAS (Nov. 2019).

Figure 3. Global Stocks to Consumption Ratio – Less China- for Corn, Soybeans, and Wheat, 2000/2001 to 2019/2020. Data Source: UDSA’s FAS (Nov. 2019).

Wrapping it Up

It’s often difficult to summarize any situation with a single graph. Global grain ending stocks are a good example of this. On the one hand, figure 1 shows global inventories have improved over the last few years but remain above the 20-year averages. However, it is worth pausing to consider a significant source of that increase in stocks, China. A large share of corn and wheat global inventories are actually tied up in China and not truly available to the global market. Considering the global grain situation less China, a much tighter stocks situation is observed.

In both cases, figures 1 and 3 show ending stocks for the three crops have trended lower in recent years; a welcome improvement. The difficulty is sizing up how tight, or burdensome, the current situation is.

China’s expanding impact on global agriculture has been a significant structural shift over the last two decades. We previously noted China’s overall reliance on trade to address the acreage-gap between what they produce and consume. Beyond trade, China has also amassed a large share of global grain inventories, potentially distorting the surface-level global ending stocks numbers. Looking ahead, one has to wonder how China’s grain inventories might trend over the next 10 to 20 years.

Source: Agricultural Economic Insights