Market Intelligence

Dextra’s market intelligence uses multiple sources of information to create a broad picture of the company’s existing market, customers, problems, competition, and growth potential for new products in new markets.

Market reports

Dextra provides detailed market analysis in order to compile all relevant information before making any investment decision about registrations and market entries. We use all available information such as panels, import data, exchanged industry data and knowledge from industry experts and distribution.

Strategic Advisory Service

A clear and well-defined strategy is a pillar for success.

Dextra’s team is integrated into our client ́s management team providing key information, expertise and advice to develop the best strategy plan, according to our client ́s needs and vision.

Search for manufacturers & Sources

Registrations require significant investments, so establishing good long-term partnerships with sources is of great importance. Dextra looks for reliable manufacturers and mediates between the manufacturer and our client to reach mutually satisfactory agreements.

Distribution Analysis

Knowing the right distribution channels is of the utmost importance in defining the most appropriate entry of our client ́s products into a new market.

Tolling partner search

Dextra has a network of approved manufacturing plants that can provide tolling activities (production and packaging) in various geographical areas and for different types of formulations such as WP, WG, SC, EC, etc.

Market monitoring alerts

Markets are constantly evolving, so Dextra performs a constant market monitoring keeping our clients updated through our alert system reporting on price evolution, newcomers, new regulations and other relevant information affecting our client ́s business.

Consultancy – Hourly Rates

Best answers, problem solving & solutions to your project needs.

Regulatory Affairs

Development and Registration of crop protection products, and unrivalled expertise to assist with the regulatory requirements for the crop protection submissions. Regulatory process under control.

European Union

Dextra provides regulatory consultancy services in the European Union, granting efficient and reliable registration processes for plant protection products, biopesticides and fertilizers. We base our work on experience, knowledge, hard work and close contact with the EU authorities.

Zonal Applications

Mutual Recognitions

Data Gap Analysis

EU Technical Equivalence

National Regulatory Processes

Taskforce Representation

Study Monitoring

Batch Review & Validation

Project Monitoring

Fertilizers registration

United States

Dextra International provides regulatory consultancy services in the USA, granting efficient and reliable registration processes for plant protection products, biopesticides and fertilizers. We base our work on experience, knowledge, hard work and close contact with the EPA & State Regulators.

Data Compensation Analysis

Dossier preparation and EPA submission for active ingredients and formulations

Taskforce Representation

Study Monitoring

Batch Revision & Validation

Project Monitoring

Latin America

Dextra International provides regulatory consultancy services in Latin America, granting efficient and reliable registration processes for plant protection products, biopesticides and fertilizers. We base our work on experience, knowledge, hard work and close contact with the Latinoamerican authorities.

Registration requirements check-list

Registration of Agrochemicals, Biopesticides & Fertilizers

Registration holding

Project Monitoring

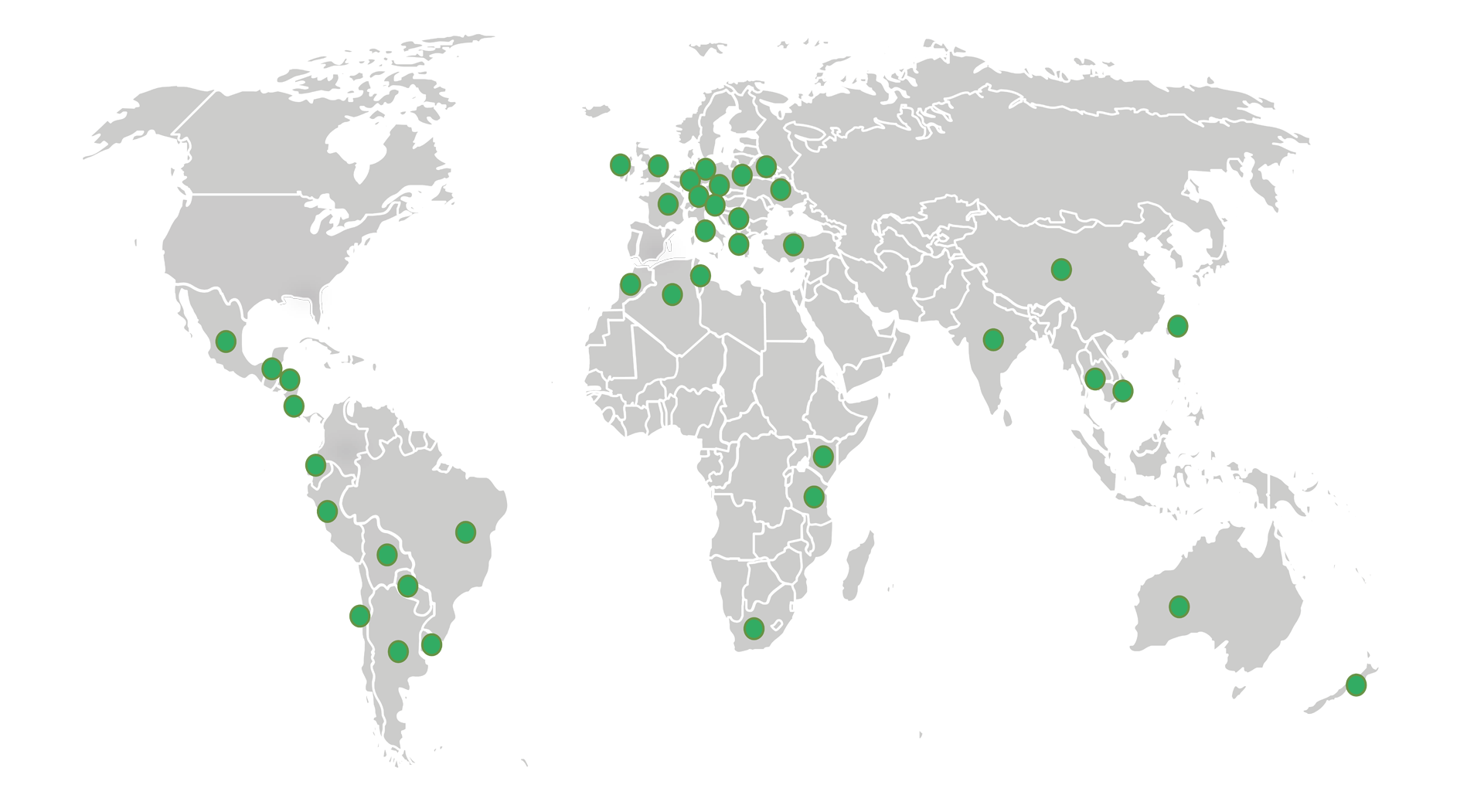

Rest of the world

Dextra offers regulatory services on a global basis, covering over 35 countries & representing 70% of the global crop protection products usage.

Registration requirements check-list

Registration of Agrochemicals, Biopesticides & Fertilizers

Project Monitoring

Sales Strategies

We identify the right channels according to each product and Market. Facilitate the best agreements and intruduce a sales monitoring and representation service, to ensure forecast achievement.

Product entry strategies

Each market has its own entry barriers. We define the best entry strategy in order to minimize cost & time, by establishing the best path to achieve sales.

Depending on our client ́s product, we define the product positioning including market segmentation, product focus, definition of competitive advantage of the product and price positioning.

Brand awareness

Brand awareness is an important matter when we talk about sales.

Once you have selected your sales channels, it is important to boost your sales, to establish a marketing campaign to reinforce your brand.

It is a double-sided plan between you and your distribution channels.

We define the best marketing campaign so that your brands get known and are visible in the market at no time.

Search and selection of distribution channels

The first step to establish the best-selling strategy is the identification and selection of the appropriate sales channels for each product. Distribution is selected according to sales and profit, geographical location, crop coverage, technical skills, purchasing power and creditworthiness, among other relevant factors.

Sales agency & Representation services

At Dextra we understand how costly it can be for a company to be present in each market. Investing in local structure, traveling costs, spotting the right channels, performance follow-up, requires full dedication and sharpness, so we encourage our clients to take advantage of our knowledge & structure to act as their commercial agent in the defined territory. In exclusivity and based on a highly transparent relationship, Dextra promotes our client ́s product, takes care of the orders and follow-ups and presents a full detailed report on the activity performance.

Sales Audit

Choosing the right partners is a vital factor for the success of any sales strategy.

The lack of communication or doing the proper follow-up regarding distributors’ activities, may turn into deep disappointment, so a proper follow-up & an in-depth knowledge of the day-to-day market, is a must if we want to be successful. We analyze your partners, ensuring they are the right ones in terms of capacity, structure & interest, we analyze their activity to double check if they are doing what you expect them to do, so after conducting this validation process, we present our conclusions in a full report, where we introduce our key recommendations.

Mergers & Acquisitions

One plus one makes three: This equation is the special alchemy of a Merger or an Acquisition. The key principle behind buying a Dossier or a Company, is to generate value over and above the investment.

Corporate Finance

From acquisitions to raising finance, our Corporate Finance team provides you with a comprehensive range of M&A and financial advisory services for any kind of industry sector.

Vendor due diligence & Vendor assistance

Vendor due diligence gives you an in-depth report on the financial health of the company you’re selling. You’ll have greater control over the sales process and the timing of the sale, which can help get you a fairer price. Our job is to look out for both buyers and sellers, taking an independent view of the business, its performance and its prospects.

The key difference between vendor due diligence and vendor assistance is that vendor assistance is provided for the benefit of the vendor only.

Valuations

Whether you are buying or selling an asset, one of your priorities will be to know exactly how much that asset is worth.

Synergy analysis & Validation

Given the importance of synergies in supporting the value of a business, we carry out a detailed review of the deal’s synergy proposals. The focus is on achievability, cost to implementation and timing of delivery.

Commercial Due Diligence

We identify potential upsides and downsides in the forecasts and provide you with key insights to help you assess the market environment.

Operational Due Diligence

Operational due diligence gives you valuable insights into the processes on which the target depends. Our team can examine and evaluate operational performance related to a potential investment and determine the financial impact.

Financial Due Diligence (Buy-Side)

Financial due diligence is all about providing you with peace of mind as a corporate or financial buyer, by analysing and validating all the financial, commercial, operational and strategic assumptions being made.

Legal Due Diligence, Deal structuring & Documentation

We’ll support you in the contractual domain over the whole transaction cycle, from negotiations to drafting the letter of intent, confidentiality and exclusivity agreements, the share purchase agreement (SPA) and the representations and warranties.